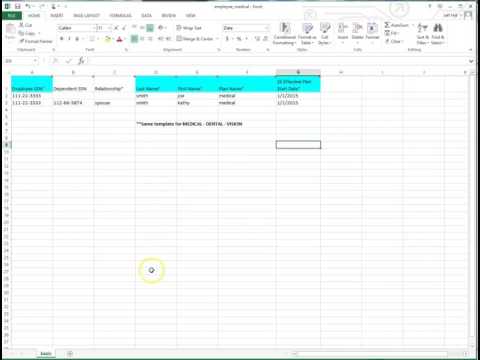

Hey everybody, it's Jeff Hill and he's back again with Jim. We want to do a second video, and this one is just about using the census templates for uploading plan selections. One of the questions we get all the time is about when to use the benefits election templates. So, if we're adding and implementing an enrollment for a group on employed navigator and it's not open enrollment in the next week or so, then people will often select to upload all the employees' current plan selections. This allows them to use the system to see their benefits and also helps them choose their current elections when open enrollment comes. What's important to note is that in order to use these templates, a lot of the work is already done. All the plans have to be pre-loaded. That's why if you see this template on the screen, there will always be a plan name on it. It has to be the same name. When building a plan, we determine the plan name for use throughout the system. This is important for referring to when you upload a template. It's super important to recognize that if you are uploading employee selections, it's for their current year, not their upcoming year. The effective date on the template corresponds to the current plan year, not the changes that will occur during open enrollment in a few months. If you have any questions about this, Jim can clarify. Now, moving on to the template for the medical, dental, and vision pages. I suggest that you submit a separate medical plan enrollment, dental plan enrollment, and vision plan enrollment. This allows us to pinpoint any skipped or misread data by the system and identify which plan it relates to. Again, as on the employee...

Award-winning PDF software

Benefit election template Form: What You Should Know

Roth IRA for Employees Join the 2.2 million Americans that are saving for their retirement in their ROTH IRA account. Employee Free Savings Plan — Forms Employers may offer a Free Savings Plan option in addition to their existing retirement plan. This allows employees to get started and set aside an amount before the employee pays taxes. The free savings plan includes an automatic contribution rate of 2% and a 5,000 pre-tax contribution. (The 401(k) match is paid out at the end of the year). Employer Free Savings Plan — Form Templates Employers may offer a Free Savings Plan option in addition to their existing retirement plan. This allows employees to get started and set aside an amount before the employee pays taxes. The 500 per paycheck 401(k) match is paid out at the end of the year. Benefits Enrollment Forms — Form Templates Roth IRA for Independent Contractors Benefits For contractors Employment and compensation Benefits Eligibility Employees must work for the employer for a year. However, the contractor can work up to 4 years. Employees must be at least 19 years of age; they must be employed in a business with less than 10 employees, for a business with 10 or more employees in total for a business with 10-50 employees or 25-50 employees. Independent Contractor's must have paid at least 5,000 in payroll for the year. The benefits are offered to employees who are 18-44 in order to account for the fact that there are fewer young workers entering the workforce. Form to be filled out in order to receive a 1099 in the case of individuals and the 1098-T, W-2 and 1099-MISC for business, can be found here, here and here. We highly recommend you fill out the form that outlines the business, date of employment and what benefits are being paid. Form to be filled out in order to receive a 1099 in the case of individuals and the 1098-T, W-2 and 1099-MISC for business, can be found here, here and here. Please note: This form is only provided for the purposes of providing the benefits to the employee, but may not include the benefits for the employer if the employer has its own policies that include providing the benefits to an employee.

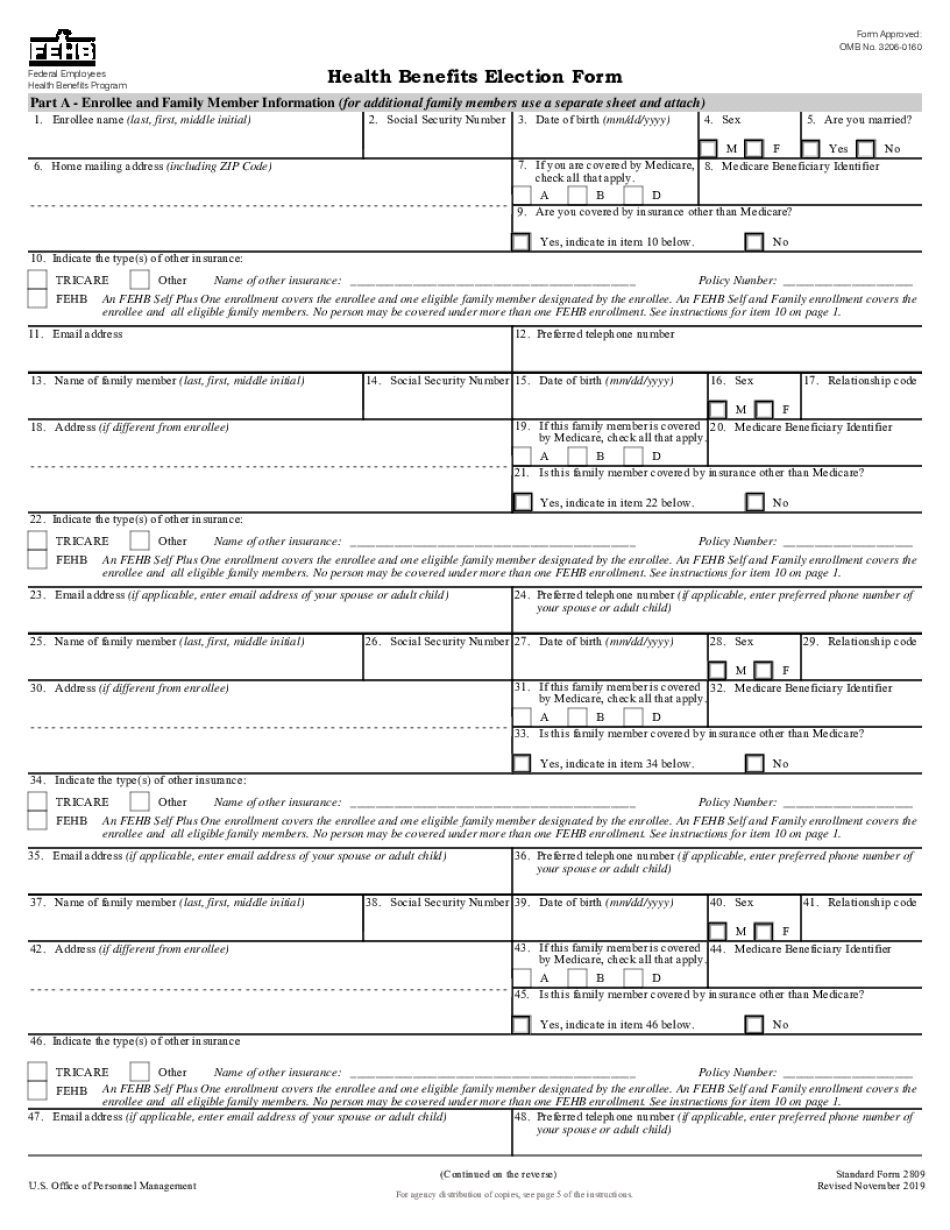

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do SF-2809, steer clear of blunders along with furnish it in a timely manner:

How to complete any SF-2809 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your SF-2809 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your SF-2809 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Benefit election form template