In this video, we're going to be taking a look at the Federal Employees Health Benefit Program (FEHB). First, let's have a brief look at what FEHB is. It was established in 1960 and is currently the largest employer-based insurance coverage in the world. The premiums and benefits remain the same whether you are working, retired, or a survivor. This means that FEHB coverage applies to you, regardless of your enrollment status. There are over 250 different plans available throughout the country under FEHB, providing you with plenty of options to choose from in your area. Now, let's discuss the three main types of plans you may come across: managed fee-for-service, health maintenance organizations (HMOs), and point-of-service plans. You have the freedom to switch between these plans on a yearly basis, allowing you to find the one that suits you best at any given time. The first type, managed fee-for-service, offers the most flexibility as you can choose any provider you prefer. However, it may require pre-certification for certain procedures and ongoing review of your care. Some managed fee-for-service plans may also include a preferred provider option (PPO), which can help reduce your out-of-pocket expenses if you choose preferred providers. The second type is HMOs, which are prepaid plans where your care is provided by a specific network of doctors and hospitals. To ensure coverage, you must stay within this network. HMOs tend to be the least expensive option but also have more restrictions compared to other plans. The third type is a blend called point-of-service providers. This type introduces the concept of in-network and out-of-network coverage. In-network costs, similar to HMOs, are typically lower for deductibles and coinsurance. However, you still have the flexibility to go out of network if needed, albeit at a higher cost. Once you have selected the ideal plan for...

Award-winning PDF software

Fehb plans Form: What You Should Know

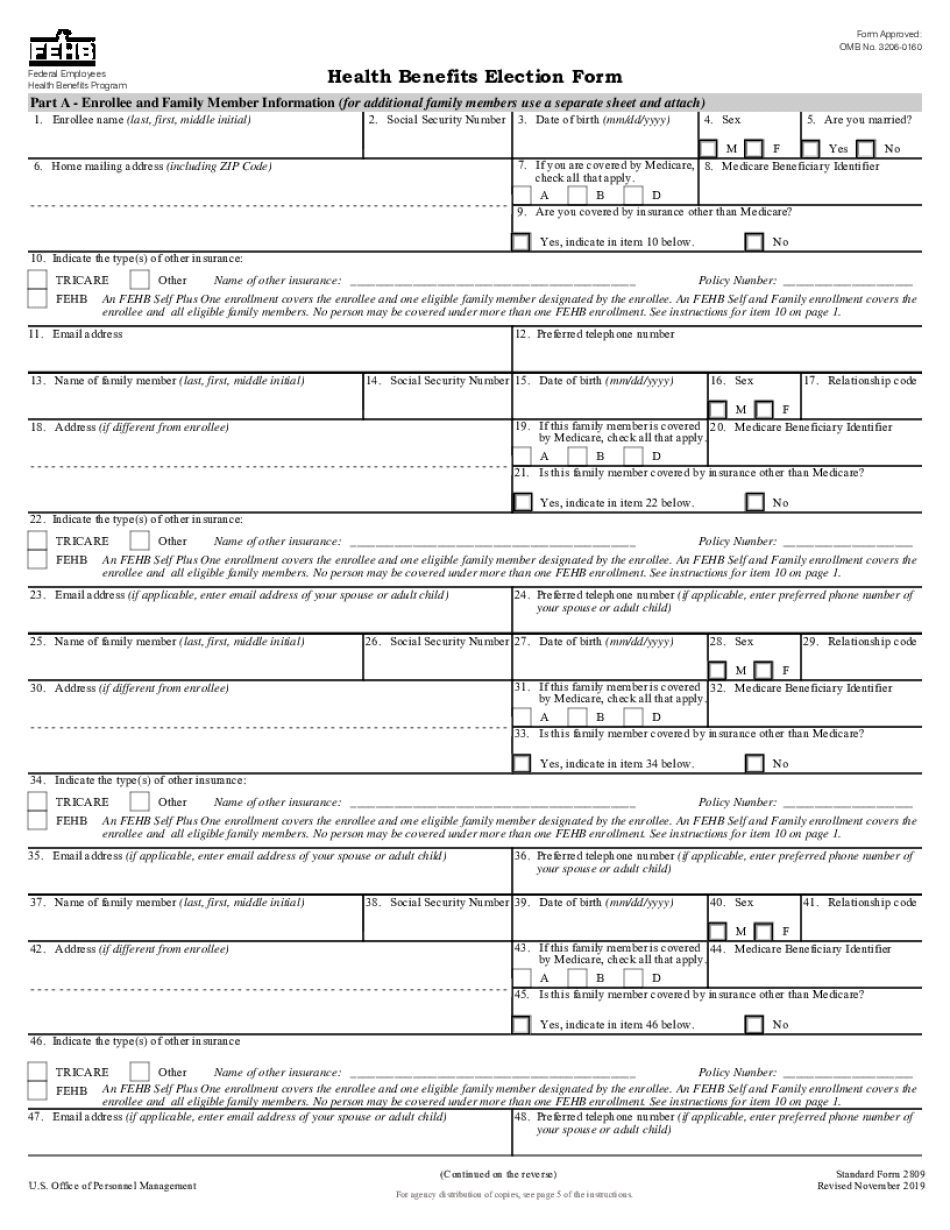

Health Benefits Election Form — OPM The OPM Health Benefits Election Form is used to enroll or change to FEB coverage. It is available here. Federal Employees Health Benefits (FED) Program (FEES) The FEES plan brochures show you the coverage and benefits for enrollment. The brochures are formatted Federal Employee FEES Plan Brochures, Forms and More. Federal Employees Health Benefits (FEES) Regulations and Information Federal Employee FEES Program (FEES) Regulations and Information. Federal Employees Health Benefits (FEES) Regulations and Information — Online. Health Benefits Election Form — GSA Health Benefits FAQ. Federal Employees Health Benefits — Online Course Find more information and help in using a GSA FEES Health Benefits Portal. Visit Health Benefits. Federal Employees Health Benefits Education Portal. The portal provides information on health benefits coverage for Federal Employees, and information about Federal Employee Health Benefit Regulations and Information. Health Benefits Election Form — GSA Health Benefits Election Form | Federal Employees Health Benefit — Online, GSA.gov. Health Benefits Election Form — GSA has information in Spanish about enrollment in the FEB Program. The Health Benefits Portal has information on how to enroll in the FEB, including eligibility and how to access information regarding benefits. Federal Employees Health Benefits (FEES) Program Federal Employees Health Benefits | FE BS Online Program. Learn where to go, how to use the FEES Program, and access useful resources. View enrollment procedures, contact information and related information. FEES — Federal Employees Benefits. The FEES Program is used to purchase the health services, equipment and materials used in Federal work places and to assist the Federal government in maintaining a healthy workforce. The website has information on the FEES Program. Federal Employees Health Benefits and Benefits Exchanges, Plans and Information — Online. GSA offers enrollment for Federal Contractors to participate in the Federal Employees Health Benefits and Benefits Exchanges, Plans and Information. Government Benefits There are many government benefits such as health, education, retirement, and others that provide the same benefits as any other health insurance plan. There are Federals and private plans and programs that pay for these types of benefits. You are most likely to get health insurance through your employer. See the Federal Government Benefits Programs page to learn more.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do SF-2809, steer clear of blunders along with furnish it in a timely manner:

How to complete any SF-2809 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your SF-2809 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your SF-2809 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Fehb plans