Federal employees and retirees approaching age 65 often have questions about how Medicare works alongside their feeble plan. One part of Medicare that generates a lot of confusion is Medicare Part B. In this video, we will focus on Part B and how it relates to the pheeba program for both active and retired employees. If you are nearing age 65, you probably already know that Part A of Medicare is premium-free, but Part B requires a monthly premium. While many people refer to Part B as the doctor portion of Medicare, it actually provides more comprehensive coverage than just outpatient and inpatient doctor visits. Part B covers services at 80 percent, with an annual deductible. In addition to doctor visits, it also covers outpatient hospital care, outpatient diagnostic tests like x-rays and laboratory tests, durable medical equipment and supplies, physical and occupational therapy, ambulance transportation, and other outpatient services. Many federal retirees wonder why they should pay Part B premiums every month when their FEMA plan already covers these same services. However, there are some significant advantages for those enrolled in both Medicare Parts A and B. Most fee-for-service plans within the pheeba program will cover the 20 percent that Medicare doesn't pay. These plans also waive deductibles and coinsurance for most medical services. They typically allow you to see any provider that accepts Medicare assignment anywhere in the country, even if they are outside the plan's network. Some plans even provide coverage for medical services outside the US, which Medicare doesn't cover. Having Medicare Parts A and B coordinated with your fee-for-service plan can provide peace of mind and a greater sense of security in retirement. It also helps to consider the financial aspect. If you decide not to enroll in Part B and you're enrolled in a fee-for-service plan within the FIBA...

Award-winning PDF software

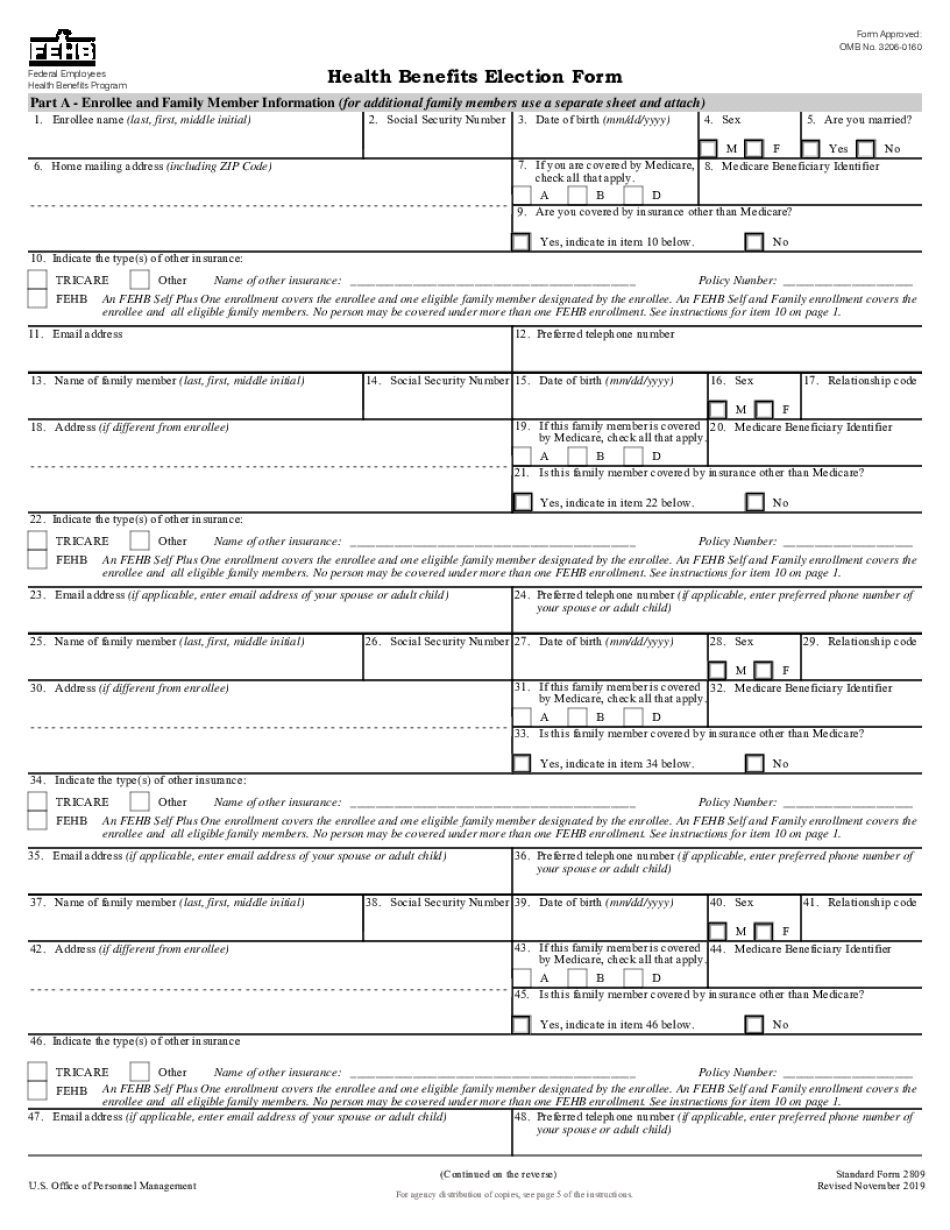

Sf 2809 revised Form: What You Should Know

May 3, 2025 — SF 2809, Health Benefits Election Form Part B — Enrolled and Family Member's Information ; Family member's name.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do SF-2809, steer clear of blunders along with furnish it in a timely manner:

How to complete any SF-2809 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your SF-2809 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your SF-2809 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Sf 2809 revised